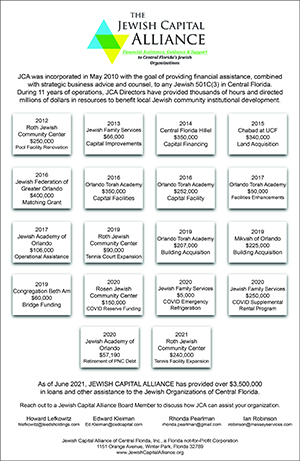

How The Jewish Capital Alliance Of Central Florida, the unknown 'community asset,' started

July 30, 2021

Throughout the coming year, The Heritage will run a half page insertion featuring an organization that has used the Jewish Capital Alliance of Central Florida to attain its chartered goals. Each of these organizations approached JCA, knowing that financial assistance could be immediately available to assist with their particular needs. What you may not know is that most of these organizations found the JCA indirectly, or thru reference, and with little knowledge of the JCA intent and structure. Over the coming year, The Heritage will pen four articles highlighting this relatively unrecognized organization; how it originated; its goals and directives; how it functions; and its success over the past 12 years of operations. This initial article will discuss how it all began.

In the winter of 2000, Judy Kahan, executive director of Kinneret Council on Aging, approached Howard Lefkowitz to join a group whose goal was to provide additional housing opportunities for Jewish seniors. Lefkowitz ultimately became chairman of a committee comprised of Kahan, Rhonda Pearlman, Mark Silverberg, and Ed Kleiman, with the goal of creating a new Adult Congregate Living Facility to serve the Orlando Jewish community. It was determined that rather than creating another lower-income Kinneret-type facility, this ACLF would service a more broadly based economic segment. It was contemplated that this new ACLF would be owned, operated, and managed by The Jewish Senior Housing Council of Greater Orlando, an entity formed in 1999 by KCOA. Seed funding for the concept would be supplied totally by the Jewish Federation of Greater Orlando, as neither the JSHC or KCOA had little, if any, financial capability. Additionally, while the concept emanated thru KCOA, two of the primary drivers of the concept, Lefkowitz and Kleiman, were community members-at-large and not affiliated with either JFGO or KCOA. In reality, it was under the auspices of the JFGO that the process of the new entity's creation would fall, even though members of the KCOA were deeply involved in initial organizational activities. Unfortunately, no formal documentation as to responsibilities between the two organizations was ever formulated. Ultimately, this would cause major discomfort that had to be resolved.

The JSHC immediately went to work to locate an appropriate site and hire consultants to assist in the design, development, and ultimately the operations of this new facility. In the spring of 2002, after two years of work, JSHC, with JFGO backing, closed upon the purchase of 25 acres of fully entitled ground in the southwest quadrant of Lake Mary Blvd. and I-4 in Seminole County. The project was named Shiralago. Today, the project as contemplated, is fully constructed and operating under the name of Oakmont Village.

In order to achieve the pre-purchase entitlements, JFGO provided initial seed money of $300,000 as a grant to KCOA, ostensibly based upon KCOA's generation of an equivalent contribution to the original Community Alliance Project, which was the primary fundraiser for expansion of community capital facilities in the 1990s. In fact, that money came from JFGO operational funding. However, prior to and including the property closing, the JFGO advanced a total of $1.6 million from its Line of Credit and further endorsed, along with JSHC, a $2.46 million loan from BB&T.

For the subsequent two and a half years, JSHC worked diligently to bring the new ACLF to fruition. However, three significant things occurred during that period. First, the JFGO was coming under severe stress carrying the $5.5 million in bond debt it had undertaken to construct and expand its Maitland campus. Secondly, the JFGO was becoming more concerned with the outstanding $1.6 million drawn against its $2.5 million Line of Credit. Thirdly, the board of the JSHC was realizing it had a "tiger by the tail." The JSHC has created the framework to create its ultimate dream goal, but came to the realization that to create a $50 million complex based on the size of community financial capability, could not be accomplished by a group of well-intended, even knowledgeable, volunteers. Therefore, in the winter of 2005, JSHC was introduced to, and ultimately created a framework with the Miami-based Royal Senior Care, a division of an Israeli real estate conglomerate, for a joint venture for the construction and operation of Shiralago. Upon execution of the agreement in April 2006, for a 50 percent ownership position, Royal Senior Care repaid $1.6 million of the JFGO Line of Credit and assumed the $2.46 million land debt from BB&T. So, it looked like after six years of work, the new Shiralago would come to fruition and the Orlando Jewish community, under the as yet-to-be-determined auspices of the JFGO and/or JSHC and/or KCOA, would become a 50 percent owner. In addition to owning an appreciating asset that provided services to its targeted Jewish community, upon stabilization, the sponsoring groups would recognize at least $300,000 per year in new revenue. All participants were ecstatic! Except, other than retiring the outstanding debt obligations, together with distribution to the community of an additional $450,000 of unanticipated cash flow, Shiralago was not to be ... at least as a Jewish Community-owned asset.

Shiralago ground break was scheduled for August 2007. In May 2007, a letter was received from Royal Senior Care advising that it did not want to enter into a "for profit" operation with a "not-for-profit" entity. Therefore, either JSHC needed to buy Royal Senior Care's position, or Royal Senior Care would purchase the JSHC position for $4.25 million. The end result was that after 7 years of volunteer effort, comprising thousands of man hours, and as much as $100,000 of their personal funds, a core group of volunteers comprised of Lefkowitz, Kleiman and Pearlman had been able to retire over $4 million in bank and JFGO debt; distribute an additional $450,000 of new funds into the Orlando Jewish community; and paid an obligatory $500,000 in taxes. The net remaining amount: $3,410,461.

Never in the history of the Orlando Jewish community had a windfall from a business transaction been created. Unfortunately, because the circumstance had not been contemplated, no formal mechanism for interagency business structure had been created. As such, there was no "blueprint" for dealing with the remaining $3.4 million. This created a very difficult and unpleasant two years of cross-discussion between the JFGO, the KCOA, the JSHC, and a handful of non-agency affiliated community members.

The funds were initially retained by JSHC, which technically was a creation of KCOA. KCOA was assumed to be an agency of the JFGO, but there was a lapse in historical documentation to affirm that status. JFGO, however, was struggling for mechanisms to retire at least $2million of the outstanding Bond Debt from the Maitland campus expansion, and very badly wanted access to those windfall funds. Notwithstanding, there was the acknowledgement that the entire JFGO financial advances to the project of both loans and seed capital had been fully repaid, with interest, as well as additional distributions of $150,000 to JFGO agencies.

KCOA's claim was obvious in that it created the JSHC, and originated the idea. However, the members of JSHC felt strongly that their non-partisan personal efforts generated and produced the Shiralago concept, as well as negotiated and created the business relationship with Royal Senior Care. The nature of their personal commitment, beyond thousands of manhours, was $100,000 in support funding when JFGO funding was exhausted. Therefore, they should be able to direct the windfall toward other Community benefits. For two and half years, many difficult and sometimes unpleasant meetings and discussions took place, both formally and informally. While a small contingency still fought for JFGO control, for the most part the recognition of the KCOA/JSHC relationship was central focus.

Creation of the new entity

It was during this contentious period that the members of the JSHC, Rhonda Pearlman, Edward Kleiman, and Howard Lefkowitz, began to identify a direction and formalize the concept that was to become Jewish Capital Alliance. The guiding premises that were to shape the future entity were: First, this financial windfall should provide capital-assistance funding to Orlando Jewish community entities capable of making a generational impact; second, these funds must be applied in an objectively business-oriented fashion; and finally, the fiduciaries of these resources, while conversant in Jewish community needs, must remain independent from community organizations, agencies, and the JFGO.

By the spring of 2010 frustration on the part of all participants finally led to an agreement as to entitlement of the $3.4 million windfall. On May 12, the JSHC Board was adjusted to consist of three members: Pearlman, Kleiman, and Lefkowitz. On June 7, the JSHC was formally terminated and replaced by The Jewish Capital Alliance, Inc., as chartered by the State of Florida. And, on Aug. 5, by executed agreement, the new JCA formally terminated any relationship to KCOA. In exchange, KCOA would receive one half of the windfall funds ($1.7 million) for use as an endowment to fund its community support programs. The JCA would retain the remaining $1.7 million for use under a newly chartered organization. On Nov. 5, the IRS issued the Assigned Employer ID # under the terms of a 501(c )3.

Months of work by the new directors ensued. JCA formalized business organizational documents, including Articles of Incorporation, By Laws, A Code of Ethics, Conflict of Interest Policy, a Whistle Blower policy, and a detailed Loan Policy, all of which govern JCA operations. Once completed, an initial Community Introductory meeting was held on Oct. 4, 2011. There in, the JCA publicly outlined its goals and intentions as follows:

"... that this windfall should be used for the long-term, multi-generational support of our Orlando Jewish Community. ... (that) we could "assist" our Jewish institutions in providing for their own capital and programming expansion, in a responsible, business like basis. ... (that) a group of experienced businesspeople, who understood the needs of our Jewish community ... could objectively assist our not-for-profits from both an advisory and a financial standpoint. The ultimate goal would be the use of our resources to provide below market-rate loans, crafted to be both responsive and affordable to our Jewish Institutions."

As of this date, Jewish Capital Alliance has increased its capital base to $3 million, and has provided over $3.5 million in loans, grants, and other assistance to agencies and entities serving the Greater Orlando Jewish community.

Reader Comments(0)